Gentlemen’s Guide to Improving Your Credit Score

No Excuses. Clean it up.

Gentlemen, having a crap credit score is not only an ungentlemanly thing to have, but it’s also completely fixable. There are resources, tricks, and actions you can take to completely change your score, so today, we’re going over the definitive guide to improving your credit score, and keeping it that way.

The first thing to understand about credit health and your score, is that it isn’t something that mysteriously appeared at no fault of your own doing. It takes a while to ruin credit, and it subsequently takes a while to bring it back into the high numbers.

Well, usually if you do it yourself. If you have a team of credit experts to help, you can make ridiculously significant improvements in just a couple of months. More on that in a minute.

Whether you’re looking to raise your score to make a big purchase (home, car, boat, etc.), or you’ve seen the power of good credit in other people’s purchases and you want it for yourself, your biggest obstacle may not be what you think.

In today’s episode, I’ll share my credit catastrophe, explain the basics of credit, the laws that are actually on YOUR side, and the secrets to getting your scores, your reports, and your life on a whole new level. This is, after all, the definitive guide to improving your credit score and keeping it that way. At the end, I have a special deal for you that might just be the jump-start you need to finally get your credit cleaned up and corrected.

Take a listen and let me know what you think in the comments below. [Subscribe Here]

Show Notes:

The first place to start when talking about credit history and credit health is with the truth. The hard truth. Your habits are usually the problem. If you received credit cards when you turned 18 and went off to college, you may have racked up a ton of debt swiping those plastic gateway drugs every chance you got. You weren’t quite aware of the real consequences, and may have figured that somehow it will all work out.

That’s exactly what I did. I turned 18, got accepted to college, and suddenly credit card offers started showing up in the mail. I figured I was a responsible enough guy, so I applied and received two cards with $500 limits each. I swiped for a tank of gas. Another for a carton of smokes. Another for a night out with my friends.

And it spiraled from there. You see, I love spending money, but not on bills. So at 18, when the bill came, I paid the minimum… if I remembered to pay at all. My habits began early. I would go out to the bars, shopping, restaurants – it was all too easy to just get what I want and worry about it later.

This was a huge mistake.

Those two cards (thank God I didn’t get any more) with $500 limits turned into a $3900 balance. By 21, I had ruined my credit and couldn’t even borrow a cup of sugar from a neighbor. The bills were there, but I wasn’t able to get on top of them, so I chose to ignore them.

That only made it worse. My step mother co-signed a student loan for me for my Freshman year, so the only thing I managed to either pay on time or put into forbearance was that loan. It was actually a saving grace. Fast forward a few years to 2004 and I want to buy a newer car.

I paid to get my three credit reports and then called my old creditors and paid the lowest balances I could to get things cleaned up. It helped, but only marginally. I managed to get approved for a car loan of $11k, for 4 years, at 19.25%.

Saying that aloud today makes me sick to my stomach. So much interest was paid. So much money wasted.

From 2004 to 2014, I did not have any credit cards. I had that car loan (which was paid off eventually), and I had my private student loan. I got used to the notion that “if it isn’t available in my bank, I simply can’t afford it right now.” This was my new habit (and one I still hold onto, albeit loosely, today).

When I met Jami, I knew I was going to marry her, but I could not allow a marriage of debt. It was time to roll up my sleeves and get to work. I had to have a respectable credit score because I wanted to build a life with her – not build a life only she could pay for because my credit was in the toilet.

So I got my head out of my ass and started doing the work. Does this mean I’m completely out of debt? No. What it does mean, however, is that I have excellent control of my credit, payment history, and credit knowledge. My bad habits of the past are exactly that: a thing of the past.

Hard Truth: Everything you’re going to learn today is useless if you don’t take action and first correct any bad habits you have. Sharpening your blade isn’t going to do you any good if you’re just going to keep cutting yourself.

What makes up your credit score

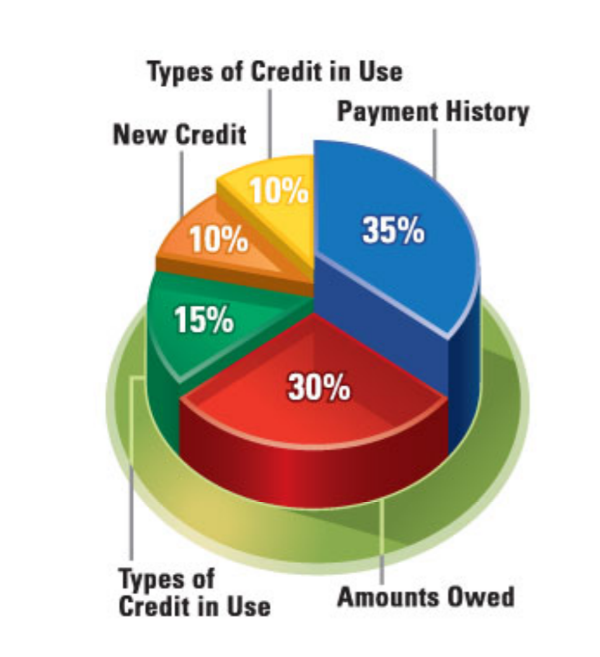

There’s a theory out there that says your debt to credit ratio (how much of your total credit line you’re using) has the greatest impact on your scores. This is false.

There’s a theory out there that says your debt to credit ratio (how much of your total credit line you’re using) has the greatest impact on your scores. This is false.

The greatest impact on your scores is found in your payment history. It is amplified by other factors, which can make it feel even more powerful in some circumstances.

For example, if you have terrible payment history (missing payments 30-60-90 days past due) but you are carrying a balance of 10% or less of your available credit, you may not notice too much suffering.

If, however, you have terrible payment history and are essentially maxed out on your credit cards, mortgage, car loan, etc., each missed payment brings you one step closer to complete ruin.

In these situations, you can get the option of a modified loan, which will help you get ahead of your debt and save yourself from bankruptcy, but missing just ONE payment on that loan will often void the entire agreement and all your hard work will be for nothing. They will prosecute and push and punish you. It’s not pretty.

Payment history is huge.

Most credit scores – including the FICO score – operate within the range of 300 to 850. The credit tiers generally look like this:

Excellent Credit: 750+

Good Credit: 700-749

Fair Credit: 650-699

Poor Credit: 600-649

Bad Credit: below 600

Beside the obvious loans (mortgage, auto, etc.), your credit score influences your rates on other everyday services too. Your mobile phone contract, lease agreement, and car insurance are also tied to your credit score. Great credit? Cheap insurance. Great credit? No security deposit. Bad credit? $500 deposit on that new Samsung Galaxy. You’ve seen in happen, but now I hope you’re starting to notice the connection.

Okay, so how do I improve my credit score?

Now that you have a little background on credit scores, health, and impact, let’s explore improving your credit score like a boss. The first line of offense in any battle, is a strong defense. Begin with a clear picture of the current situation.

Get your free credit reports

Every year, you can download your credit reports from all three credit reporting agencies (Experian, Equifax, and TransUnion) from AnnualCreditReport.com. You can access all three reports after verifying your personal information and downloading as a PDF. Make sure you do this ONLY on a computer (no tablets or mobile devices), and DO NOT close your browser window during the process or you could lose everything.

Once you’ve got your reports, the next step in this guide to improving your credit score is to have the ability to check it. Free. Daily.

Get your credit scores

www.Credit.com is a free service that gives you the ability to see your Experian credit score. Again, this service is FREE. If you are asked to pay for it, you’re inadvertently signing up for something else. Go to www.Credit.com and sign up today.

www.CreditKarma.com is another free service that gives you the ability to see your Equifax and TransUnion scores. This services used to have all three scores, but Experian like to play by its own rules, so it began its own service (previously mentioned). Go to www.CreditKarma.com and sign up today.

Check for errors on everything

Check for errors on everything

Now that you have your scores and reports, check each for errors. You can see current debts, lenders, balances, and personal information. You’ll also see past lenders, closed accounts, possible charge-offs, judgments, public records, and even outdated employment information.

If you see an error on your report, you can dispute it legally. Included in your reports are the contact numbers and addresses to send your dispute letters. You can also file disputes electronically from the three reporting agency websites: Experian, Equifax, TransUnion.

NOTE: One of the things I experienced when I started my DIY adventure was that results were hit or miss. If my dispute letter wasn’t written correctly or sent to the exact address for that account, it was ignored and I lost. Occasionally, I would receive a notice that my dispute was received and they removed that data. Again, I was operating on hope and luck, which was frustrating.

Create a plan

The next thing to do is create a plan. Is your strategy to reduce debt? Create a pay-off plan. Is it to remove errors and dispute old accounts? Create a dispute plan. Track everything. Every call, every email, every letter, every change to your reports — you want to make sure your bases are always covered. The credit reporting agencies are not on your side. They’re not here to help you, and they are designed to punish, rather than protect. Even the FCRA (Fair Credit Reporting Act) is designed to help you, but only if you read and understand it.

Record your collection/creditor calls

This doesn’t apply if you aren’t receiving any collection calls from creditors, but if you are, listen closely. Even if you’re being sued by a creditor, you are well within your legal rights to end the phone calls. You can request they stop calling you, add your number to their do not call list, and communicate ONLY via postal mail. Provided your number is listed on the national do not call registry, every call you receive thereafter is a violation of the TCPA (Telephone Consumer Protection Act).

Why is that important to know? Because once you hit a certain number of violations, it’s in your best interest to take the creditor to small claims court. Each violation could reward you with $500. Some law firms specialize in pursuing TCPA violations, and it might award you enough money to pay off the original debt anyway. While this knowledge won’t directly go to improving your credit score, it’s always nice to know there are laws that can help you if you understand them.

Pay down balances

Now that you know what you’re working with, what your reports actually look like, and what kind of scores you have, it’s time to pay down balances and get more green lights. One of the absolute BEST things you can do for yourself and your payment history is setup an auto payment for each of your credit cards.

Even if it is set to pay the minimum balance, it will ensure that no payments are missed and give your payment history the love it may need. It’s always recommended you pay more than the minimum so you stay ahead of the curve, but this minimum auto-payment will create your payment safety net.

Become an Authorized User

Once your payment history is on point and your balances are either gone or small, you will probably see a much higher score. If you’re still not able to get the right financing on a home or vehicle, it might be due to a lack of available credit. Even with a credit score of 780, you can still suffer with high interest rates if your credit limits are too low.

Once your payment history is on point and your balances are either gone or small, you will probably see a much higher score. If you’re still not able to get the right financing on a home or vehicle, it might be due to a lack of available credit. Even with a credit score of 780, you can still suffer with high interest rates if your credit limits are too low.

If your credit limit is only $10k, you will struggle to get a low interest rate on a $50k car purchase. If your available credit is over $50k, you’ll more often than not, get the green light to sign on the dotted line for minimal interest rates.

One of the ways you can increase your credit limit is by becoming an Authorized User on someone else’s credit line. Sometimes a spouse can add you as an authorized user, sometimes it’s a close friend or family member, and sometimes it’s someone different entirely.

It’s a tall order because they need to have excellent credit and a large available credit line, and you need to have excellent payment history and be trustworthy. Many times, the new user (you) won’t receive a credit card to the new person’s account, but his or her credit line will appear on your reports. That’s the safest and most effective way to make an impact. As long as neither of you screw up your balances or payment history, it can often be a match made in heaven.

Bankruptcy is not the only way

When it feel like it’s all too much, you might think bankruptcy is the answer. Well, it’s not the only answer. There are programs out there that help to make your debt manageable, digestible, and most importantly, negotiable. Companies that specialize in debt settlement and debt consolidation work to reduce balances and interest rates. Credit counseling helps you create better habits and patterns so you can systematically get out of trouble.

When it feel like it’s all too much, you might think bankruptcy is the answer. Well, it’s not the only answer. There are programs out there that help to make your debt manageable, digestible, and most importantly, negotiable. Companies that specialize in debt settlement and debt consolidation work to reduce balances and interest rates. Credit counseling helps you create better habits and patterns so you can systematically get out of trouble.

There are even companies that help clean up your reports, correct errors, and dispute accounts for you. Some of them can make incredible changes a reality for you. One such company is ReCredit. I’ve been working with them since mid 2017, and have seen incredible things happen to both my credit health, and my scores.

ReCredit has an amazing team of people in Vegas that work to remove negative items from your report and get your score to the next level. Their program is easy to start, and most people (myself included) saw the changes I wanted within the first 90 days.

Their basic program –the one I did– is normally $149 per month, and doesn’t include any long-term contract. You can use it for 6 months to completely change your credit health, and then move on.

I had so much success with them (my current scores are 793 791, and 793), that I asked if there was a way to reward my listeners if I could promote it on my show. They agreed. Now you can take $20 off your first month!

Go to www.ReCreditServices.com and use coupon code FIRST20 at checkout to take $20 off your first month.

Look, gentlemen, there is absolutely no reason to have a crap credit score anymore. When you said, “Someday I’ll get it cleaned up,” – well, that someday is here. Now. You owe it to yourself, your family, and your future self to get your credit cleaned up, corrected, and taken to the next level.

I did it, and I know you can too. Don’t bury your head in the sand. Face it head on and wrestle old habits into submission. You too can purchase a car at 0.9% APR. It’s a pretty Kick-Ass feeling knowing you’re not longer getting killed by interest rates.

Do it for you. Do for whatever reason you like. Do it today.

Have you worked with a company to clean up your credit?

What was your experience? Do you still have a few things

you’re trying out move beyond?

Leave a comment below so we can connect!